All Categories

Featured

Table of Contents

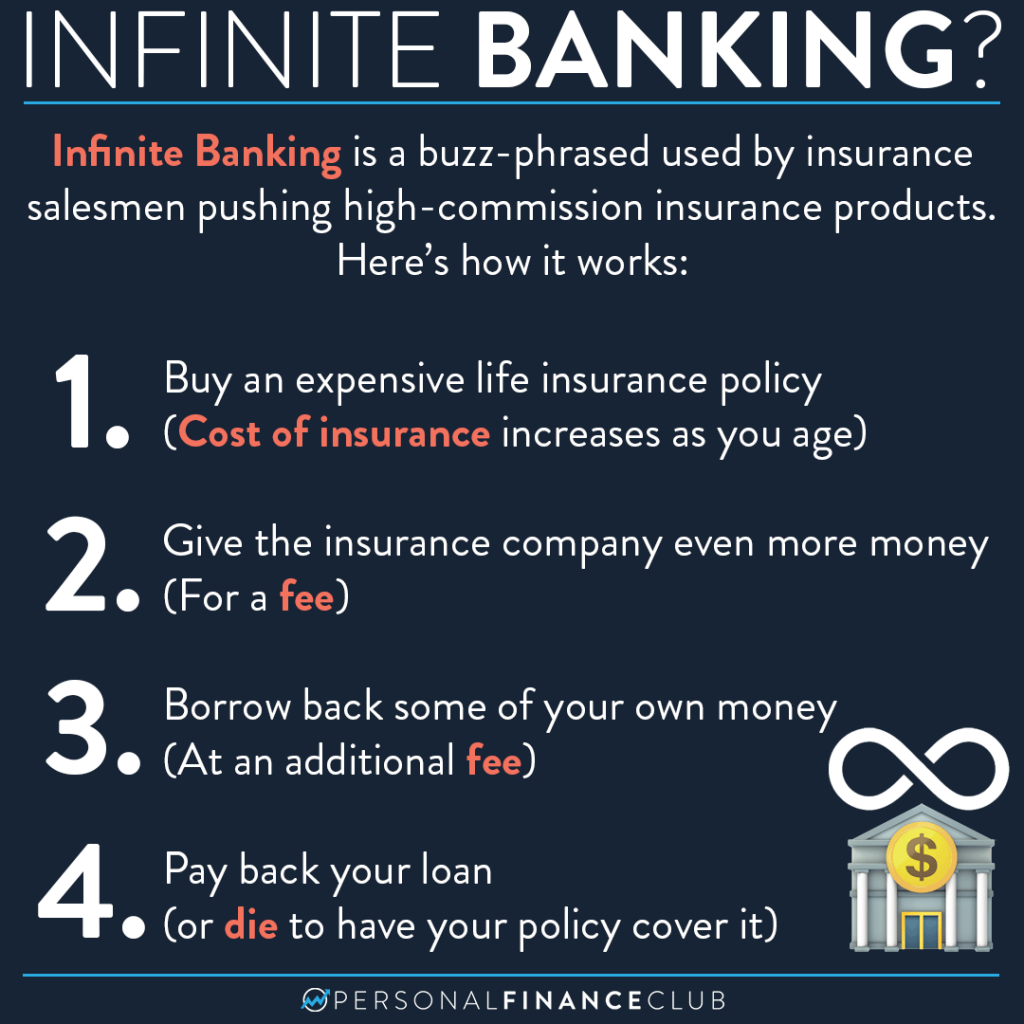

The technique has its own benefits, but it likewise has concerns with high fees, complexity, and more, causing it being concerned as a scam by some. Boundless financial is not the most effective plan if you require just the financial investment component. The infinite financial concept revolves around making use of whole life insurance policy policies as a monetary tool.

A PUAR enables you to "overfund" your insurance coverage plan right approximately line of it ending up being a Modified Endowment Contract (MEC). When you make use of a PUAR, you rapidly raise your cash money value (and your fatality benefit), consequently boosting the power of your "bank". Additionally, the even more cash money worth you have, the greater your interest and dividend payments from your insurance provider will certainly be.

With the rise of TikTok as an information-sharing system, monetary recommendations and approaches have located a novel method of dispersing. One such approach that has actually been making the rounds is the boundless banking idea, or IBC for short, garnering endorsements from celebs like rap artist Waka Flocka Flame - Cash flow banking. Nevertheless, while the technique is currently popular, its origins trace back to the 1980s when financial expert Nelson Nash introduced it to the world.

What makes Cash Value Leveraging different from other wealth strategies?

Within these policies, the money value grows based upon a rate established by the insurer. As soon as a considerable money worth builds up, insurance holders can obtain a cash worth lending. These lendings differ from standard ones, with life insurance policy offering as collateral, suggesting one can lose their coverage if borrowing excessively without appropriate money worth to sustain the insurance costs.

And while the allure of these plans is evident, there are natural restrictions and threats, demanding thorough cash value tracking. The strategy's legitimacy isn't black and white. For high-net-worth people or entrepreneur, particularly those using techniques like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and compound development might be appealing.

The appeal of unlimited financial doesn't negate its obstacles: Cost: The fundamental requirement, a permanent life insurance policy, is costlier than its term counterparts. Qualification: Not everyone gets approved for entire life insurance policy because of extensive underwriting procedures that can leave out those with certain health and wellness or lifestyle problems. Intricacy and danger: The detailed nature of IBC, coupled with its dangers, may hinder many, particularly when less complex and less dangerous alternatives are readily available.

How does Cash Flow Banking compare to traditional investment strategies?

Alloting around 10% of your month-to-month revenue to the policy is simply not viable for many individuals. Utilizing life insurance as an investment and liquidity resource needs self-control and monitoring of plan cash money value. Get in touch with a monetary expert to establish if infinite banking lines up with your concerns. Component of what you review below is just a reiteration of what has actually currently been claimed over.

So before you get yourself right into a situation you're not prepared for, know the adhering to initially: Although the principle is generally offered as such, you're not in fact taking a finance from yourself. If that held true, you wouldn't need to repay it. Rather, you're borrowing from the insurance policy company and need to settle it with interest.

Some social media posts advise using money worth from whole life insurance coverage to pay down debt card financial debt. When you pay back the financing, a portion of that passion goes to the insurance policy firm.

What financial goals can I achieve with Infinite Banking Retirement Strategy?

For the very first a number of years, you'll be paying off the payment. This makes it extremely challenging for your policy to build up worth throughout this time. Entire life insurance policy expenses 5 to 15 times a lot more than term insurance coverage. Lots of people simply can't manage it. So, unless you can pay for to pay a few to a number of hundred bucks for the next years or even more, IBC will not benefit you.

Not everyone should count solely on themselves for economic safety and security. Wealth management with Infinite Banking. If you need life insurance coverage, right here are some important tips to consider: Consider term life insurance. These plans supply coverage throughout years with significant monetary commitments, like home loans, pupil finances, or when looking after kids. Ensure to shop about for the very best rate.

What type of insurance policies work best with Infinite Banking Cash Flow?

Think of never ever having to fret regarding financial institution finances or high interest rates once more. That's the power of unlimited financial life insurance coverage.

There's no collection lending term, and you have the liberty to choose on the repayment timetable, which can be as leisurely as paying back the financing at the time of death. This versatility encompasses the servicing of the financings, where you can choose for interest-only repayments, keeping the funding equilibrium level and workable.

Is Generational Wealth With Infinite Banking a good strategy for generational wealth?

Holding money in an IUL fixed account being attributed rate of interest can often be much better than holding the cash on deposit at a bank.: You've always desired for opening your own pastry shop. You can obtain from your IUL policy to cover the first costs of renting out a room, buying tools, and hiring team.

Individual finances can be obtained from standard banks and cooperative credit union. Here are some bottom lines to consider. Bank card can give a flexible way to borrow cash for very short-term periods. Obtaining cash on a credit score card is generally really costly with yearly portion rates of rate of interest (APR) frequently getting to 20% to 30% or more a year.

Latest Posts

How Do I Start Infinite Banking

Family Banking Strategy

Your Family Bank - Become Your Own Bank - Plano, Tx