All Categories

Featured

Table of Contents

The method has its very own advantages, yet it additionally has issues with high costs, intricacy, and extra, resulting in it being considered a scam by some. Unlimited financial is not the very best policy if you require just the investment part. The infinite financial concept focuses on the use of entire life insurance policy policies as a monetary tool.

A PUAR allows you to "overfund" your insurance coverage plan right approximately line of it ending up being a Changed Endowment Agreement (MEC). When you make use of a PUAR, you rapidly boost your cash value (and your survivor benefit), therefore boosting the power of your "bank". Additionally, the more cash money worth you have, the greater your rate of interest and dividend settlements from your insurance policy business will be.

With the surge of TikTok as an information-sharing system, economic recommendations and approaches have actually discovered a novel way of spreading. One such approach that has actually been making the rounds is the boundless banking principle, or IBC for short, amassing recommendations from celebrities like rapper Waka Flocka Fire - Generational wealth with Infinite Banking. While the method is currently preferred, its roots trace back to the 1980s when financial expert Nelson Nash presented it to the world.

Can Infinite Banking Concept protect me in an economic downturn?

Within these policies, the cash worth grows based on a rate set by the insurance provider. Once a considerable money worth builds up, policyholders can get a money value financing. These lendings differ from conventional ones, with life insurance offering as collateral, suggesting one could shed their insurance coverage if borrowing exceedingly without appropriate cash money worth to support the insurance policy costs.

And while the appeal of these policies appears, there are natural limitations and risks, necessitating persistent money value monitoring. The strategy's legitimacy isn't black and white. For high-net-worth people or organization owners, specifically those using strategies like company-owned life insurance (COLI), the advantages of tax breaks and compound development could be appealing.

The attraction of boundless financial does not negate its difficulties: Expense: The fundamental demand, an irreversible life insurance policy policy, is costlier than its term equivalents. Qualification: Not every person receives entire life insurance policy because of extensive underwriting processes that can exclude those with specific health and wellness or way of life conditions. Intricacy and threat: The intricate nature of IBC, coupled with its dangers, might deter numerous, especially when simpler and less risky choices are readily available.

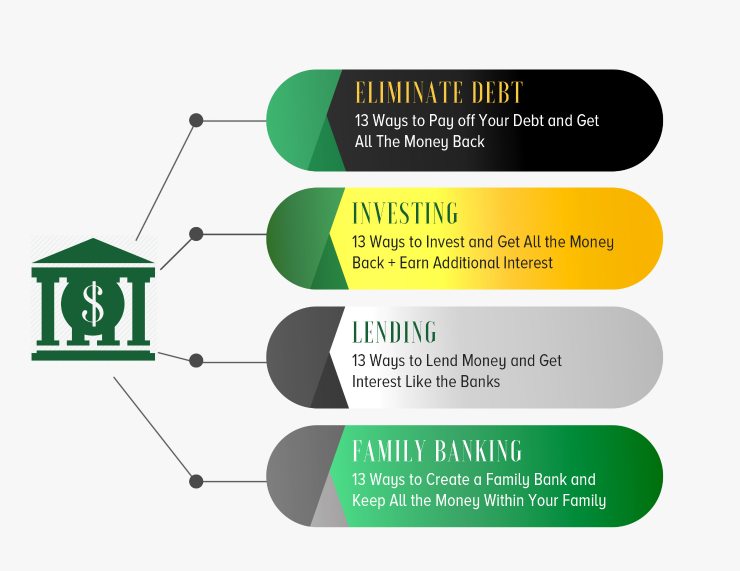

Infinite Wealth Strategy

Allocating around 10% of your monthly income to the policy is simply not practical for a lot of people. Component of what you read below is simply a reiteration of what has actually currently been stated over.

So prior to you obtain into a situation you're not planned for, know the adhering to initially: Although the concept is generally marketed because of this, you're not in fact taking a lending from yourself. If that held true, you would not need to repay it. Instead, you're borrowing from the insurance provider and need to repay it with rate of interest.

Some social media posts advise making use of cash value from entire life insurance to pay down credit report card financial obligation. When you pay back the finance, a section of that passion goes to the insurance business.

What type of insurance policies work best with Infinite Banking Cash Flow?

For the first several years, you'll be settling the compensation. This makes it very challenging for your plan to build up value throughout this moment. Entire life insurance expenses 5 to 15 times a lot more than term insurance. Many people just can't manage it. So, unless you can pay for to pay a few to several hundred bucks for the following years or more, IBC won't work for you.

Not everyone needs to count entirely on themselves for financial protection. Policy loan strategy. If you need life insurance policy, below are some important tips to consider: Consider term life insurance policy. These policies offer insurance coverage during years with significant financial responsibilities, like mortgages, trainee lendings, or when looking after kids. See to it to search for the finest rate.

Can I use Infinite Banking Account Setup to fund large purchases?

Envision never ever having to fret about bank car loans or high passion prices once more. That's the power of boundless banking life insurance.

There's no set lending term, and you have the liberty to select the settlement routine, which can be as leisurely as paying off the funding at the time of death. This versatility includes the servicing of the car loans, where you can choose interest-only repayments, keeping the finance balance flat and manageable.

What is the best way to integrate Life Insurance Loans into my retirement strategy?

Holding cash in an IUL fixed account being credited rate of interest can commonly be better than holding the money on deposit at a bank.: You have actually always dreamed of opening your own bakeshop. You can borrow from your IUL policy to cover the first expenses of leasing a space, purchasing devices, and hiring personnel.

Personal car loans can be acquired from conventional financial institutions and cooperative credit union. Here are some key factors to consider. Credit rating cards can supply a versatile means to obtain cash for extremely temporary periods. Obtaining money on a debt card is normally really expensive with yearly portion rates of rate of interest (APR) typically reaching 20% to 30% or more a year.

Latest Posts

How Do I Start Infinite Banking

Family Banking Strategy

Your Family Bank - Become Your Own Bank - Plano, Tx